If you have just started university, we are sure that you are busy meeting new people, attending Freshers events, settling in and adjusting to your new academic environment. As important as these are, there is another goal you need to start thinking about when you start university, and that’s planning for your future career.

What should I be doing in my first year of university?

Beginning to think about and plan for your future as early as possible is the best way to ensure that you are prepared for graduation and ready to move on to a successful career in the right industry for you.

The first thing you should be doing is considering your options and deciding exactly what that career might be. If you are reading this article, the chances are you are considering a career as an actuary and are doing research about the profession before you start pursuing an actuarial career.

Luckily, we have plenty of information on becoming an actuary, from what qualifications you need to what skills you need to demonstrate to help you be sure that a career as an actuary is right for you.

An actuarial career is a hugely rewarding one, but because of that, it is also a hugely popular one. Therefore, you will need to start preparing early to maximise your chances of success.

Where can I meet recruiters in my first year?

Meeting recruiters is a great way to establish links with potential employers and find out more about themselves and the profession. But where do you meet recruiters in your first year?

On campus

Your university careers service is a good place to find out about events on campus. There are a lot of great opportunities to meet and establish links with employers, who will visit campus regularly throughout the year.

Some bigger employers may be on campus for drop-in sessions and workshops that you could take advantage of. We advise you going to your university careers service and checking in your subject department for any specific events that may be of interest.

Insight Days

Many of the big graduate employers hold insight days aimed at first years. These insight days are a great way to meet potential employers, find out more about their training schemes, what the application process involves and to just generally make a good impression.

In such a competitive industry as the finance industry, head-hunting happens very early on, so it’s vital to get involved in events like these as much as possible.

What does an insight day involve?

An Insight Day is similar to an open day and you will take part in a number of sessions which will help you develop your knowledge of the company and the actuarial profession. Activities could consist of things such as;

- Presentations from people at the firm

- Networking with current trainees

- Application and interview sessions

- Employability skills sessions

- Q&As

Although insight days are a more informal event, they can also double-up as mock assessment centres, so it’s important you stand out. To do this, you will have to dress smartly, research the company and the areas they specialise in, and show a good level of commercial awareness. Take every opportunity to ask questions, talk to the current trainees, and get to know the people also on the insight day.

Some graduate employers, such as APR, also offer the opportunity to attend inside weeks or Talent/Leadership Academies. These last from three to five days and aim to go beyond a basic introduction to the company and the profession, instead they go into more detail about the profession and seek to develop your professional skills.

Internships and work experience

Internships are usually only offered to those in their penultimate year of university. However, companies may offer shorter internships or work experience while in your first year or going into your second year.

Any form of work experience is a great way of exploring your career options and deciding whether or not an industry is right for you. You will also gain valuable experience and learn skills that you will need to demonstrate in future interviews.

If you are thinking of applying for an internship or a work experience place, then you will have to start applying as early as you can in your first term as they fill up very quickly. You can find the latest internships on our website.

Societies and volunteering in your first year at university

One of the first things you can do as a student to help your future career is to get involved in some societies. Many societies, especially subject specific and entrepreneurial societies are valued and can even be actively targeted by employers.

- Joining a society can help you in lots of different ways:

- Network and meet other people who share your interests

- Demonstrate your commitment and interests in a specific area

- Gain valuable experience by taking an organisational role within the society, such as treasurer.

- Provide examples of your ability to manage multiple responsibilities

Volunteering is also a great way of developing skills outside of your academic work that will make you more employable. It is also a great way to give back to the community, obviously.

Should I create a CV in my first year?

While it might seem early, it is never too early to start building your CV.

Your CV is a document that needs constant refinement. Once you have started getting involved with societies and volunteering opportunities, update your CV with all the details. It is also a good idea to start making your CV more tailored to the actuarial profession; bringing out the relevant skills and interests and summarising your ambitions in the profile section. While it might not seem like a priority now, it will save you a lot of time further down the line.

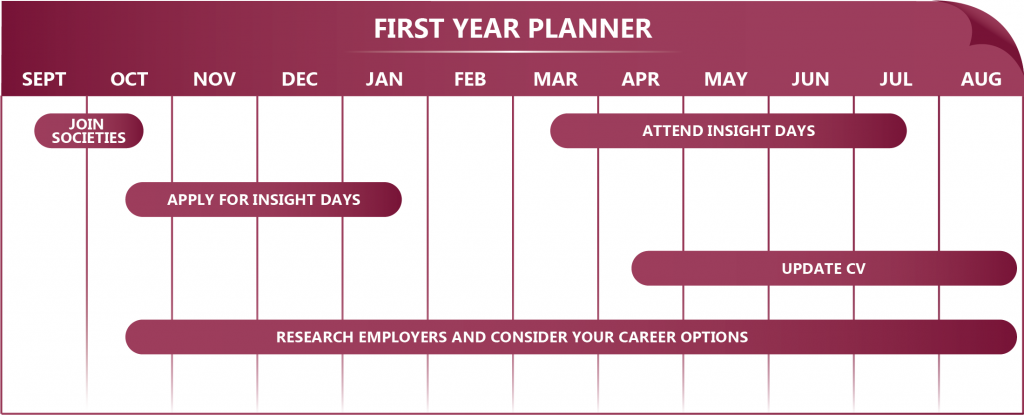

In conclusion, in your first year at university you should start looking at the work experience and insight days that recruiters are offering. You should also look at joining societies and taking up any volunteering opportunities that you think may be of interest. Hopefully this has given you some idea of what you should be doing in your first year when it comes to career planning, and if you want to visualise your year, you can take a look at our career planner below!